Blog > Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

Recalling the housing crash of 2008 is something that most of us can do, even if we weren't homeowners at the time. However, if you find yourself concerned about the possibility of history repeating itself, there's some reassuring news to consider – today's housing market is fundamentally different from what we experienced in 2008.

One critical distinction lies in the balance of supply and demand. Unlike the excess supply that characterized the market in 2008, the present situation is marked by a shortage of available homes. To trigger a market crash, an oversupply of houses would be necessary, but the data indicates otherwise.

Housing supply originates from three primary sources:

- Homeowners opting to sell their properties.

- Newly constructed homes.

- Distressed properties, including foreclosures and short sales.

Let's delve into the current housing inventory to better understand why it differs from 2008.

Homeowners Deciding To Sell Their Houses

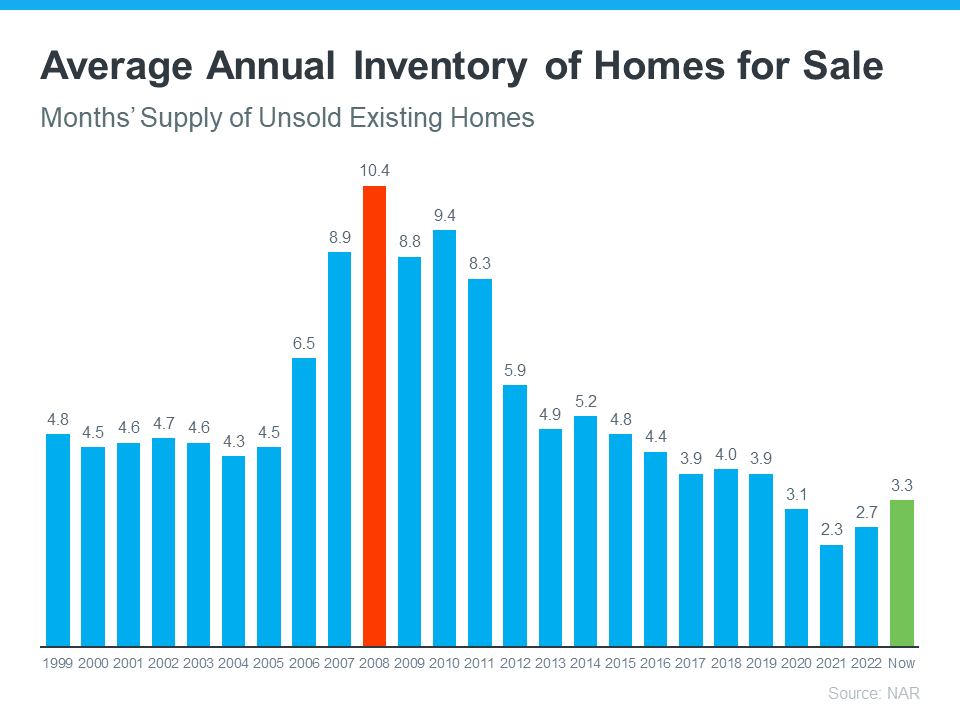

While housing supply has increased compared to the previous year, it remains relatively low. The current months' supply is below the typical level. The graph below illustrates this disparity, with the latest data shown in green and a comparison to 2008 shown in red. Today, we have only about one-third of the available inventory compared to 2008.

So, what does this indicate? Simply put, there aren't enough homes on the market to cause a decline in home values. A repeat of 2008 would require a substantial increase in homeowners selling their properties with a scarcity of buyers, which is not the case at present.

Newly Built Homes

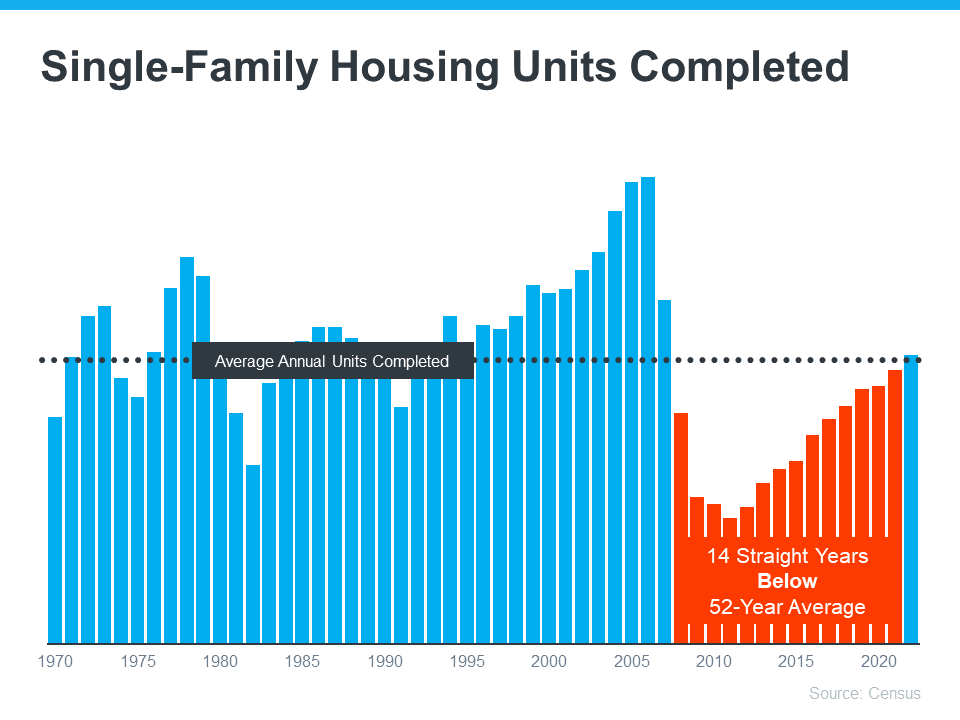

There's been a lot of talk lately about the construction of new homes, leading to concerns of overbuilding. The graph below demonstrates the number of new houses built over the past 52 years.

The 14 years of underbuilding (shown in red) are a significant contributor to the current low inventory. Builders have not been constructing enough homes for many years, resulting in a considerable supply deficit. Although construction is picking up, as indicated by the final blue bar on the graph, it won't suddenly lead to an oversupply. The gap is too vast to bridge, and builders are being cautious about not overextending themselves, as they did during the housing bubble.

Distressed Properties (Foreclosures and Short Sales)

Another source of housing inventory is distressed properties, such as short sales and foreclosures. During the housing crisis, an influx of foreclosures occurred due to lenient lending standards that allowed many individuals to secure home loans they couldn't genuinely afford.

Today, lending standards are far stricter, resulting in a higher number of qualified buyers and significantly fewer foreclosures. The graph below, utilizing data from the Federal Reserve, illustrates how things have changed since the housing crash.

As lending standards tightened and buyers became more qualified, the number of foreclosures began to decline. In 2020 and 2021, a combination of foreclosure moratoriums and forbearance programs helped prevent a recurrence of the foreclosure wave seen around 2008.

The forbearance program was a game-changer, offering homeowners options such as loan deferrals and modifications that were not available before. Data on the program's success indicates that four out of every five homeowners exiting forbearance have either paid their debts in full or established a repayment plan to avoid foreclosure. These factors significantly reduce the likelihood of a wave of foreclosures flooding the market.

What This Means for You

Inventory levels are far from reaching the levels required for significant price drops and a housing market crash. According to Bankrate, this situation is unlikely to change anytime soon, especially considering the persistent strength of buyer demand:

"This ongoing shortage of inventory explains why many buyers continue to face limited choices and bid up prices. It also indicates that the supply-and-demand dynamics won't permit a price crash in the foreseeable future."

Bottom Line

The housing market lacks the surplus of available homes necessary for a repetition of the 2008 housing crisis, and there's no evidence to suggest that this will change in the near future. The data on housing inventory assures us that a market crash is not looming on the horizon.