Blog > Saving for a Down Payment? Here’s What You Need To Know.

If you're planning to buy your first home, you may be concerned about the costs involved, especially the down payment. However, contrary to popular belief, a 20% down payment is not always necessary. According to the National Association of Realtors (NAR), many housing consumers have misconceptions about down payment requirements and homeownership. A recent survey by Freddie Mac confirms this misconception, revealing that nearly a third of prospective homebuyers believe a down payment of 20% or more is required. Let's explore the reality and discover how you can get closer to your homebuying dream.

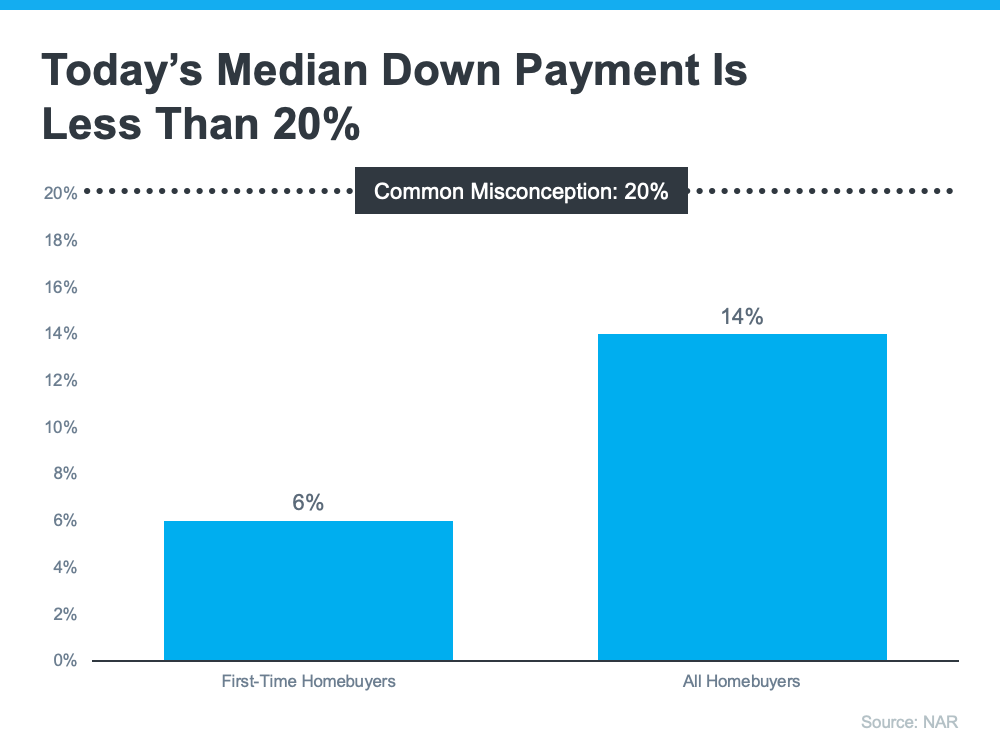

The truth is that a 20% down payment is not typically required unless specified by your loan type or lender. NAR reports that the median down payment for all homebuyers today is only 14%, and for first-time homebuyers, it's just 6%. This means you may not need to save as much as you initially thought, bringing your homeownership goals within reach.

There are also misconceptions about down payment assistance programs. Over 2,000 programs exist in the U.S., and they're not just for first-time buyers. In fact, more than 38% of these programs cater to repeat homebuyers who have owned a home in the last 3 years. Additionally, loan types like FHA, VA, and USDA offer low or no down payment options for qualified applicants.

Don't let down payment myths hold you back. Connect with us to discuss your homebuying goals and explore the possibilities.