Blog > Lending Standards Are Not Like They Were Leading Up to the Crash

The current housing market bears little resemblance to the 2008 crash, and one key factor is the transformation of lending standards. Let's explore how these standards have evolved over the years.

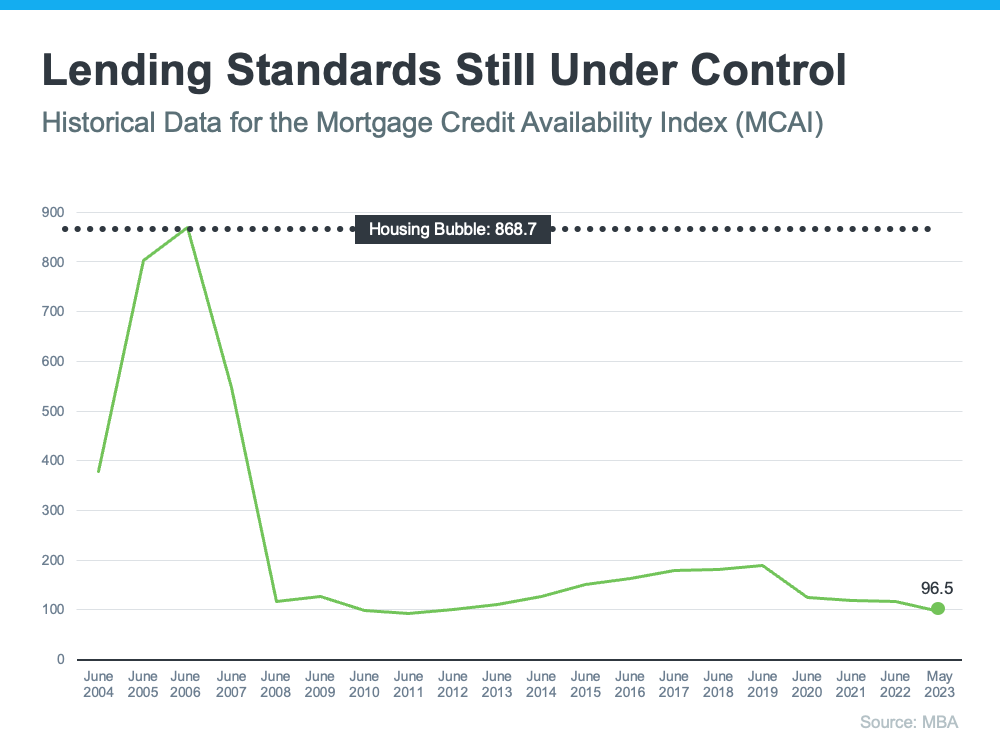

The Mortgage Credit Availability Index (MCAI): The Mortgage Bankers Association (MBA) releases the MCAI, which measures mortgage credit availability. Examining its graph since 2004 provides insights into changing lending standards.

Pre-2008: Loose Lending Standards: Before the crash, relaxed lending standards allowed individuals with inadequate financial means to secure mortgages. Credit was widely available, leading to excessive risk.

Tightening of Standards: Post-2008, lending standards significantly tightened. The MCAI graph shows a decline, indicating stricter regulations. Today's standards are even more stringent than in 2004.

A Different Housing Market: The decreasing MCAI demonstrates tougher lending standards, making today's market distinct from the past. Borrowers undergo comprehensive evaluations, reducing risk for both lenders and borrowers.

Conclusion: Today's housing market features significantly tighter lending standards compared to 2008. Stricter regulations ensure greater stability and responsible lending practices, offering reassurance against another housing crash.