Blog > How Inflation Affects Mortgage Rates

When browsing through the news about the housing market, you may come across discussions about the Federal Reserve's recent decisions. But how does this actually affect your plans to buy a home? Here's a breakdown of what you need to know.

When browsing through the news about the housing market, you may come across discussions about the Federal Reserve's recent decisions. But how does this actually affect your plans to buy a home? Here's a breakdown of what you need to know.

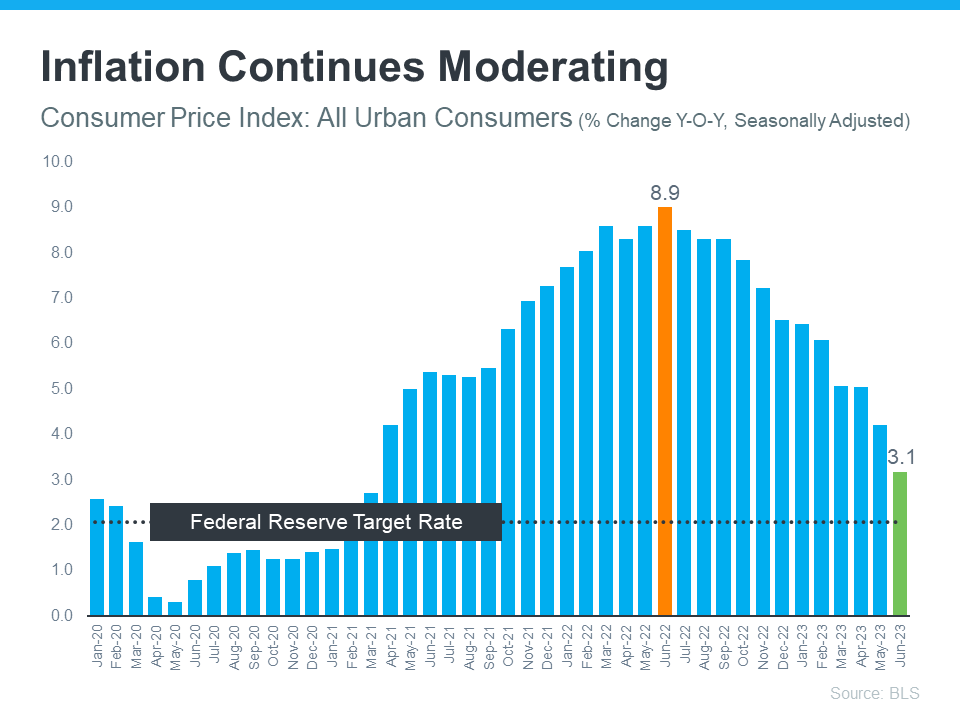

The Federal Reserve, commonly referred to as the Fed, has been diligently working to combat inflation. Despite witnessing 12 consecutive months of inflation cooling down, recent data still indicates that it remains higher than the Fed's target of 2%. You might have hoped that the Fed would halt its rate hikes as they make progress in curbing inflation, but they are cautious about stopping too soon, as that could potentially lead to inflation climbing back up. Thus, the Fed made a decision to increase the Federal Funds Rate once again last week, as stated by Jerome Powell, Chairman of the Fed, who emphasizes their commitment to bringing inflation back to the 2% goal and keeping long-term inflation expectations stable.

Greg McBride, Senior VP and Chief Financial Analyst at Bankrate, explains how high inflation and a robust economy contribute to the Fed's recent decision. Inflation remains stubbornly high, and the economy has demonstrated remarkable resilience. However, this strength in the economy might be a contributing factor to the persistent inflation, necessitating the Fed to exercise caution by applying further brakes.

While a Federal Funds Rate hike doesn't directly determine mortgage rates, it does have an impact. As explained in a recent article from Fortune, the federal funds rate is the interest rate that banks charge each other when lending money. When inflation is high, the Fed raises rates to increase borrowing costs and slow down the economy. Conversely, when inflation is too low, the Fed lowers rates to stimulate economic activity and promote growth.

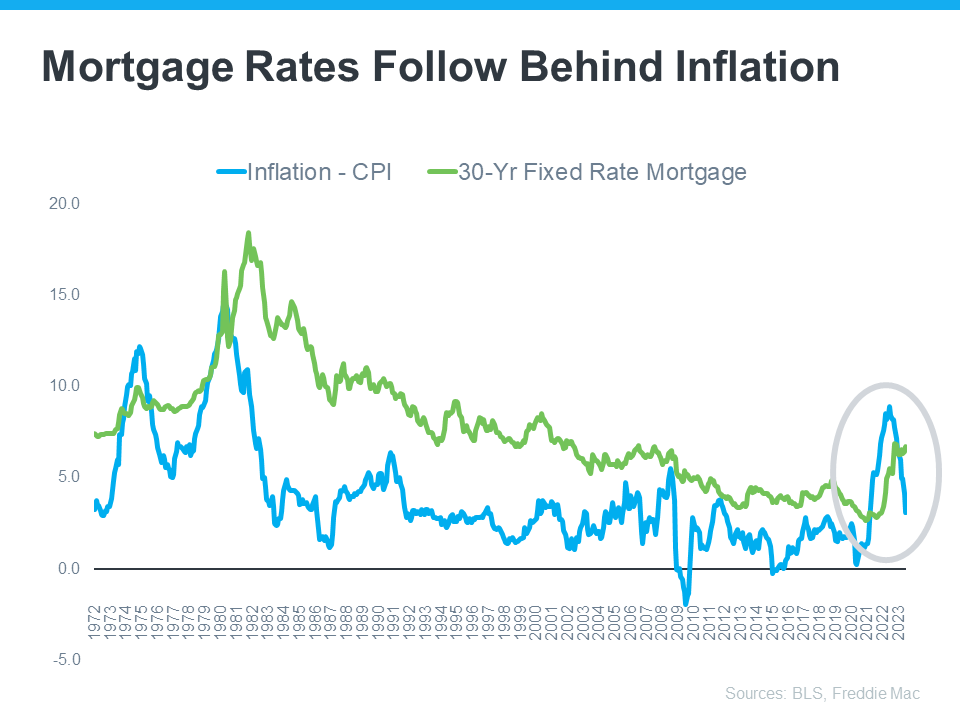

So, how does all of this influence you? In simple terms, when inflation rises, mortgage rates also tend to increase. However, if the Fed successfully brings down inflation, it could lead to lower mortgage rates, making homeownership more affordable for you.

A clear illustration of this point is depicted in the graph below, showing the correlation between inflation and mortgage rates. As inflation decreases (blue trend line), mortgage rates usually follow suit (green trend line):

Based on historical trends and the data presented above, as inflation gradually comes down, we can anticipate more consistent declines in mortgage rates throughout the year. Greg McBride is optimistic about the future of mortgage rates and suggests that with easing inflation pressures, we should see a noticeable slowdown in rates, especially if the economy and labor market exhibit signs of deceleration.

In conclusion, the trajectory of mortgage rates is closely tied to inflation. Should inflation cool down, mortgage rates are likely to follow suit and go down as well. To navigate these market changes effectively, it's wise to seek expert advice on the housing market. Don't hesitate to reach out so you can make informed decisions about your home buying plans.