Blog > Don’t Expect a Flood of Foreclosures

With rising costs affecting daily life, there's been talk about potential mortgage payment struggles and a looming wave of foreclosures. But before we worry too much, let's take a closer look.

Bill McBride, a housing market expert who predicted the 2008 crash, has a different view this time:

"We're not headed for a foreclosure crisis."

Here's why experts think so:

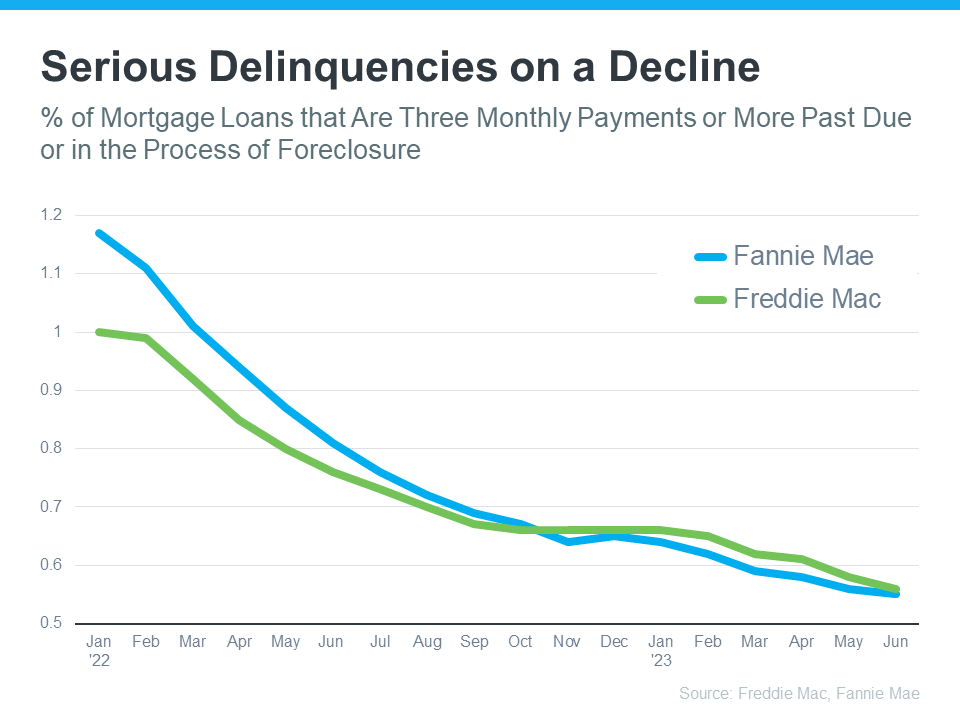

Few People Are Really Behind on Mortgage Payments Last time, easy lending standards let many people get mortgages without proving they could pay them back. But things have changed. Stricter rules mean today's buyers are better qualified. Data from Freddie Mac and Fannie Mae show fewer homeowners are seriously behind on their mortgage payments (see graph):

Molly Boese, an economist, explains:

"In May, mortgage delinquencies hit a record low. Even serious delinquencies are down. The number of mortgages overdue by six months or more, which spiked in 2021, is now back to 2020 levels."

For a foreclosure wave, more people would need to miss payments. Since most buyers are paying on time now, a big foreclosure surge is unlikely. So, don't worry – today's data doesn't suggest a major crisis. Qualified buyers are sticking to their mortgages at a strong rates.