Blog > Are Home Prices Going Up or Down? That Depends…

The media's coverage of home prices can often be perplexing, primarily because of the data utilized and the aspects they emphasize. When it comes to comparing home prices over various time periods, two distinct methods are employed: year-over-year (Y-O-Y) and month-over-month (M-O-M). Let's delve into the details of each approach.

Y-O-Y Comparisons: Y-O-Y measures price changes from the same period in the previous year. It reveals annual growth rates and overall market appreciation or depreciation.

M-O-M Comparisons: M-O-M measures price changes from one month to the next, capturing short-term fluctuations, supply/demand shifts, and seasonal patterns.

The key difference between Y-O-Y and M-O-M comparisons lies in the time frame being assessed. Both approaches have their own merits and serve different purposes depending on the specific analysis required.

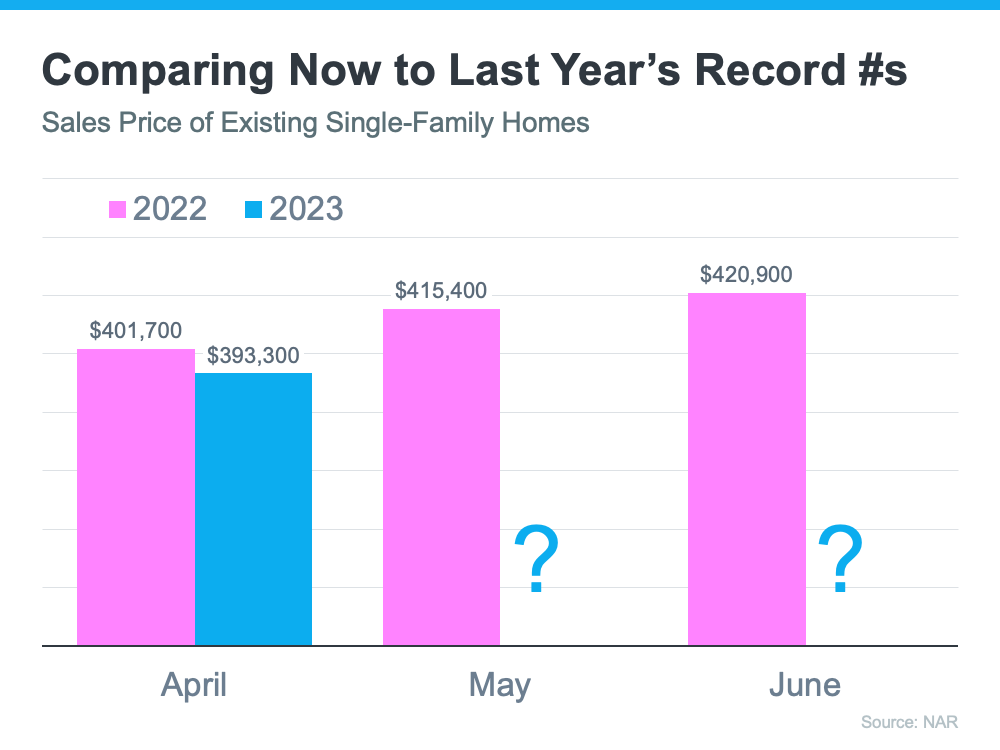

In the upcoming months, home prices may be lower compared to the same period last year. Record-breaking months in 2022 might not be surpassed this year, resulting in a depreciation in year-over-year (Y-O-Y) comparisons. Initial data, especially for April, suggests a potential downward trend. See the graph below:

During periods of negative headlines and potential misunderstandings about home prices, it is crucial to consider the bigger picture. Buying a home at this time offers significant advantages. Buyers can acquire properties at discounted prices compared to the previous year's peak, taking advantage of the phase known as "buying at the bottom." This strategic approach positions buyers favorably before prices start to rise again, potentially leading to long-term value and growth.

To make well-informed decisions, it is essential to rely on accurate information rather than sensational headlines. Real estate professionals with a deep understanding of the market can provide valuable insights and guidance. By considering both year-over-year and month-over-month trends, buyers can ensure a comprehensive assessment and make informed choices that align with market dynamics.

If you have questions about what’s happening with home prices, or if you’re ready to buy before prices climb higher, let’s connect.